Gusto tax calculator

When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. GST tax calculator is an online calculator which calculates tax amounts that are payable for a particular financial or assessment year.

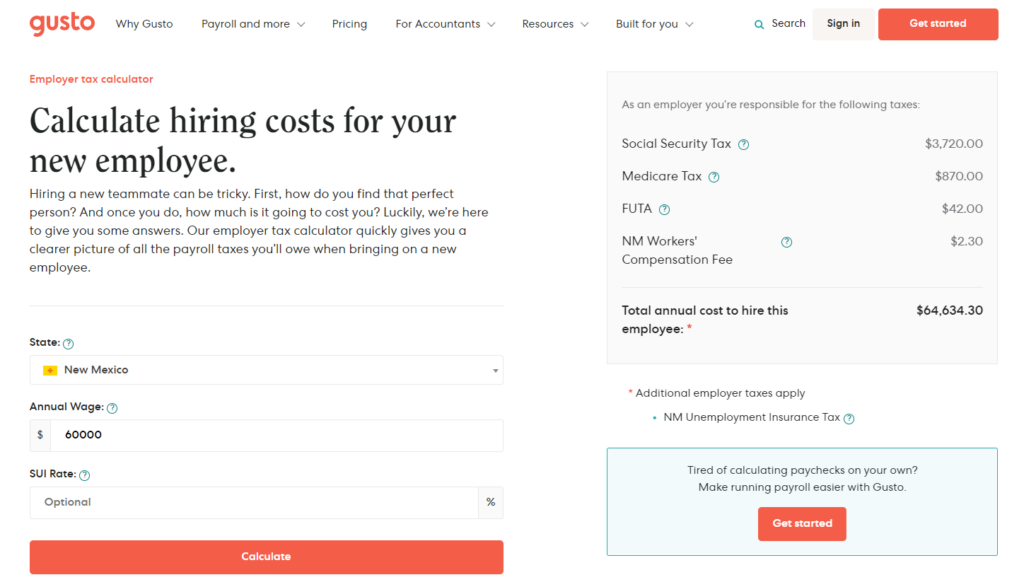

Payroll Tax Calculator For Employers Gusto

Request Your Free ERC Analysis.

. If the below information does not answer your question try our article about editing company details there youll find information about updating your. Ad Payroll So Easy You Can Set It Up Run It Yourself. See If You Qualify.

Get Your Quote Today with SurePayroll. Ad Our Resources Can Help You Decide Between Taxable Vs. Here are the GST slab rates according to which tax is.

Save Time Money and Headaches with Our Award Winning Software for Small Businesses. Federal Salary Paycheck Calculator. Get Started Today with 1 Month Free.

Request Your Free ERC Analysis. Ad Calculate Federal State Payroll Taxes Deductions and the Local Taxes. Gusto calculates employees federal income tax using the tax withholding information entered in Gusto and the.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. The calculator on this page uses the percentage method which calculates. Well do the math for youall you need to do is enter the.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. And is based on the tax brackets of 2021 and. See If Your Business Qualifies For the Employee Retention Tax Credit.

Price of this payroll tax calculator software starts from 289635 per user per month. It is mainly intended for residents of the US. Gustos payroll benefits and HR platform is trusted by more than 200000 businesses and their teams.

Federal income tax FIT is withheld from employee earnings each payroll. App APIs to help customers sync and share data between your product and Gusto. There are two ways to calculate taxes on bonuses.

The percentage method and the aggregate method. Usually the vendor collects the sales tax from the consumer as the consumer makes a. Well Handle All Your Filing.

Well Handle All Your Filing. Documentation and developer guides. See If Your Business Qualifies For the Employee Retention Tax Credit.

Subtract any deductions and. See If You Qualify. All Services Backed by Tax Guarantee.

Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Your employer withholds a 62 Social Security tax and a.

Manage your federal tax details.

![]()

Zenefits Vs Gusto Which Hr Software Is The Winner For 2022

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

How To Add Pre And Post Tax Deductions Gusto Youtube

Paycheck Calculator Calculate Hourly Pay Gusto

Gusto Review Pcmag

Gusto Formerly Zenpayroll Time Tracking Made Easy Quickbooks

How To Calculate Payroll Taxes In 5 Steps

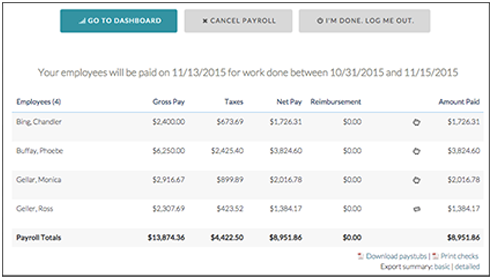

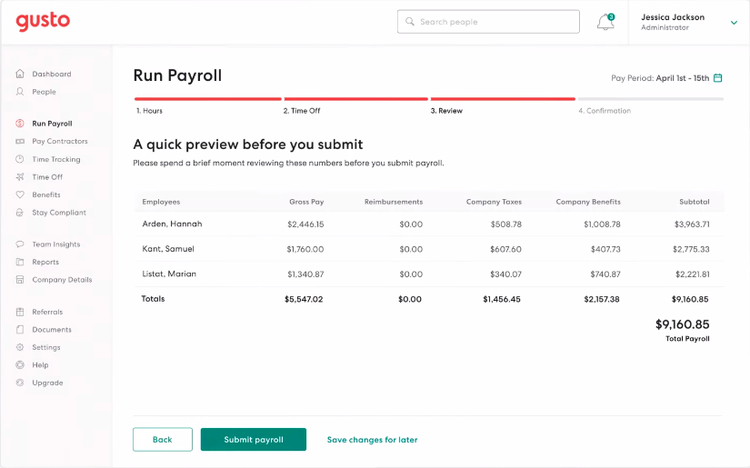

Gusto Payroll

Switch Your Payroll Provider To Gusto S People Platform Gusto

6 Free Payroll Tax Calculators For Employers

Gusto Vs Adp Pricing Features More 2022

Paycheck Calculator Calculate Hourly Pay Gusto

Gusto Review Pcmag

Payroll Tax Calculator For Employers Gusto

Gusto And Sunrise

Free Payroll And Hr Resources And Tools Gusto

10 Best Free Payroll Calculator In India Fy 2021 22 Paycheck Calculator